The PARADIGM Shift: Spring 2025 Edition

Industrial Real Estate | Market Update

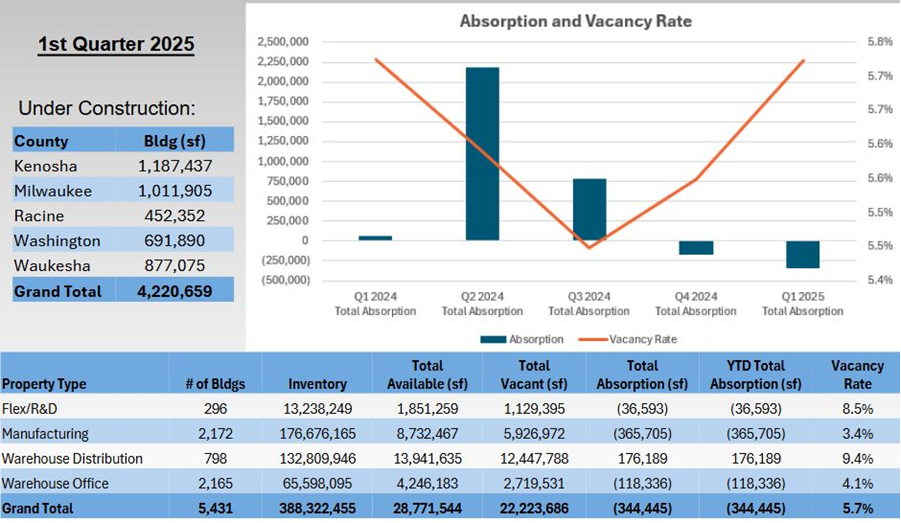

The Southeast Wisconsin industrial market saw mixed results in Q1 2025, with overall negative absorption of 344,400 SF driven by large single-tenant vacancies. Kenosha County led leasing activity with strong deals from Uline and ID Logistics, while multi-tenant properties performed well with 396,500 SF of positive absorption. Vacancy rates held steady at 5.7%, with active new construction adding over 4.2 million SF to the market.

PARADIGM Real Estate is helping clients navigate these changing market conditions with local expertise, strong broker relationships, and tailored strategies. Whether leasing, selling, or acquiring industrial space, we’re ready to uncover opportunities and position our clients for success in Southeast Wisconsin’s evolving industrial real estate market.

How PARADIGM Can Help: “Industrial real estate isn’t just about space—it’s about strategy. Companies that secure the right locations today will lead the market. At PARADIGM, we don’t just broker deals; we create competitive advantages for our clients.” Brian Parrish, MBA, SIOR, President & CEO. At PARADIGM Real Estate, we specialize in industrial and investment real estate, providing expert guidance to help businesses and investors seize market opportunities and stay ahead of the curve. Contact PARADIGM Real Estate today to discuss your strategy.

– FEATURED LISTINGS –

For Sale or LEASE

6161 North 64th Street

Milwaukee, WI 53218

DOWNLOAD BROCHURE

- 186,835 SF on 21.29 Acres

- Tall ceilings, heavy power, ample parking, loading

- Rail spur possible

- Great location with access to public transportation

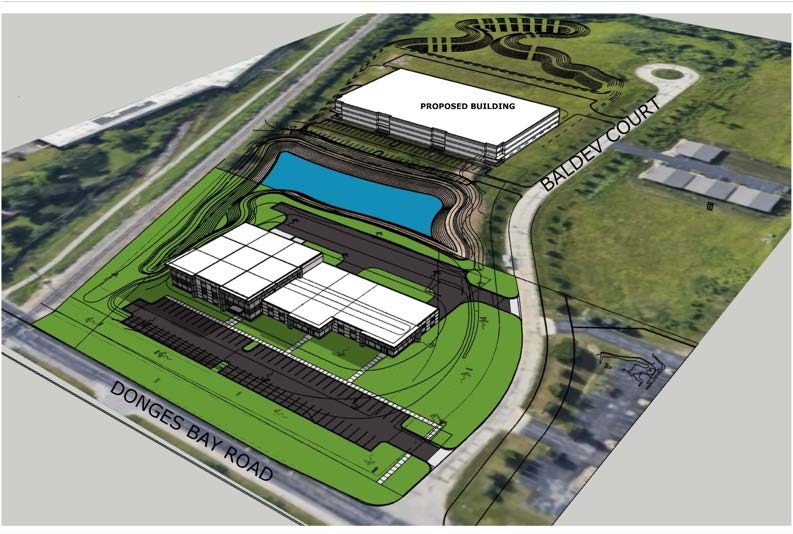

Build-to-Suit For LEASE

10325 North Baldev Court, Lot 2

Mequon, WI 53092

DOWNLOAD BROCHURE

- Up to 54,000 SF on 25.85 Acres

- Ample loading and parking

- Occupancy approximately 18 months

- Convenient location in Ozaukee County

JUST SOLD!

PARADIGM Real Estate Corp. represented Rexnord Industries, LLC, with the sale of their 753,076 SF campus on 56.02 acres located at 4701 W Greenfield Ave. in Milwaukee.

Phoenix West Milwaukee Industrial Investors, LLC purchased the real estate and has a strong track record of revitalizing industrial properties across the country.

“This transaction highlights the continued strength and resiliency of Milwaukee’s industrial sector,” said Brian Parrish, MBA, SIOR. “The former Rexnord campus represents an exciting opportunity for future redevelopment and investment.”

Read more here.

PARADIGM specializes in the sale and lease of industrial and investment real estate in Wisconsin since 2013

SALE & LEASE LISTING REPRESENTATIONPROPERTY VALUATION

SALE LEASE-BACK ANALYSIS

SITE SEARCH & DEVELOPMENT

PARADIGM Real Estate Brokers

President & CEO

Vice President & Partner

Vice President